Canfor Customer Update

Welcome to our latest edition of the Canfor Customer Update. Your feedback is appreciated, and helps us identify the topics that are most important to you.

Wishing you a happy holiday season and all the best in the New Year.

Sincerely,

Sincerely,

Wayne Guthrie

Enhanced Marketing Roles Mean

Better Service

We have expanded the roles of Frank Turnbull and Kevin Pankratz in our Wood Products Marketing organization to support Canfor’s production growth and expanded product line, and provide better overall customer service.

Frank becomes Divisional General Manager for Canfor Southern Pine Sales and Marketing. He will lead the integration of our SYP sales into North America while working with offshore offices to expand our SYP export volume.

Kevin is Divisional General Manager for SPF Sales and Marketing. He will take on the expanded role of North American sales in addition to his responsibilities for supply chain and offshore sales to non-Asian markets.

“Canfor’s aggressive growth in SYP lumber represents an exciting opportunity,” says Frank. “Kevin and I will be working with our sales teams to leverage the combined strengths of our quality SYP and SPF products so we can meet the needs of customers in markets at home and around the world.”

“I look forward to growing our market presence for both SYP and SPF while maintaining our industry-leading customer satisfaction in both product lines,” says Kevin. “This integrated marketing team is a great way to meet customer needs for dimensional lumber.”

Rail Transportation Update

We’re confident we will be able to strategically utilize an improved rail system to better serve our customers this winter, and won’t see the severity of the transportation challenges we faced earlier this year.

One major benefit is the significant investment CN has made to its network so it can improve its car supply performance to our lumber mills this winter. We will be keeping a close eye on CN’s performance, and will look for immediate solutions if we find it is slipping below intended levels. And we want to find ways to increase our non-CN options for the north, including increasing loading at Edmonton by 67%.

CN has already added 60 new locomotives and 950 new centerbeam cars, and increased its allocation of pooled boxcars – and it plans to add another 120 locomotives in 2015. The company has hired more than 3,500 employees across the system, and trained more than 400 managers to work as conductors and engineers should they be required. We are optimistic that these improvements and our contingency plans will mean efficient transportation for our products this winter. We have an excellent working relationship with CN and will work closely with them to maintain optimal service levels.

Finding Ways to Strengthen On-time

Shipping Performance

We had a rough start to 2014 with record cold and snow, the truckers’ strike at the Port of Vancouver, and service issues as we introduced our new ERP system. While a lot of these were out of our control, we know we can do better.

We are taking immediate steps to improve our on-time shipping performance, including:

- Refining the customer portal to provide enhanced information using push technology.

- Creating a tactical team to review, prioritize and resolve all late orders quickly.

- Taking greater ownership for getting products to customers, and finding ways to mitigate disruptions caused by everything from weather to rail car issues.

Other specific actions for 2015 include plans to re-launch the Canfor RED brand strategy with the goal of creating a clear and concise value proposition, and to increase the market’s awareness of our Douglas-fir and SYP product offerings.

Many of these improvements have been designed based on direct feedback from our customers – we sincerely appreciate the commitment of our customers to continue to work with us to strengthen our service.

Market Outlook

We are closing out the year with steady demand in North America. We had good Q3 sales, and most U.S. customers also had a solid quarter with great weather. SPF lumber prices will likely drift higher in the first quarter of 2015, mirroring the trend for the last few years.

U.S. Outlook

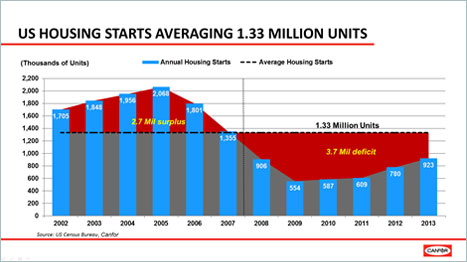

November housing figures suggest the residential real estate market in the United States is beginning to gather momentum, thanks in large part to declining mortgage rates, moderating house prices and a stronger consumer climate. Favourable demographic trends and pent-up demand should lead to a positive long-term outlook for new home construction. Canfor expects U.S. housing starts will average 975,000 this year, 1.1 million in 2015 and 1.3 million in 2016. Overbuilding during the boom pales in comparison to underbuilding during the bust – it is estimated that the U.S. housing sector is currently underbuilt by about 3.7 million units.

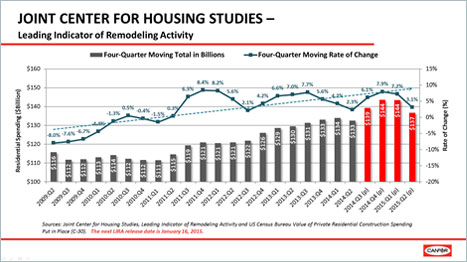

The Joint Center for Housing Studies at Harvard University says the repair and remodeling industry will improve by about 7% in both Q4 2014 and Q1 2015 before easing to 3% in Q2 2015. Spending on residential improvements should increase over the next few years due largely to pent-up demand, project delays during the recession, millions of foreclosures where new owners took on homes in need of repairs, and an overall improving economy. Spending should return to its long-term trend in 2018-2019.

Lumber Supply and Pricing

The growth of Canada’s production capacity will be limited by timber supply constraints, with lower annual allowable cuts in British Columbia and Quebec in the latter half of this decade. Production is forecast to increase 0.5 billion to 0.75 billion fbm next year – about 2% to 3% higher than this year. It should increase moderately in 2016 as the fibre supply stabilizes.

All U.S. lumber-producing regions have seen significant growth in timber inventories due to the downturn in the sawtimber harvest. In 2015, total U.S. lumber production will increase 1.5 billion to 2.0 billion fbm, up 5% to 6% from 2014. More than half of this production increase is from the U.S. South.

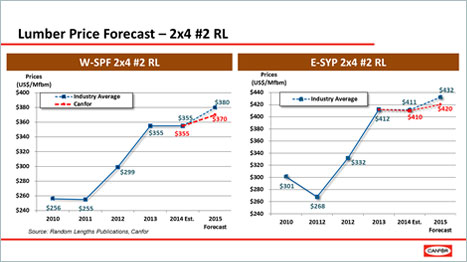

The steady rise in demand will outpace rise in supply and push prices higher in 2015. The W-SPF 2x4 #2 forecast is $370/Mfbm in 2015 versus an estimated $352/Mfbm in 2014. E-SYP 2x4 #2 is also expected to increase to $420/Mfbm ibn 2015 from $410/Mfbm in 2014.